TLA continuously researches and monitors economic and market trends on behalf of the families we serve.

The Buffett Era

2025 marks the end of an era. 95-year old Warren Buffett steps down on December 31 as the chief investment officer and “face” of one of the most successful investment firms in generations, Berkshire Hathaway. Buffett learned about “value investing” under the tutelage of his Columbia School of Business professor, Benjamin Graham. Think Luke and Yoda.

According to Buffett, also known as the Oracle of Omaha, “The basic ideas of investing are to look at stocks as business, use the market’s fluctuations to your advantage, and seek a margin of safety… That’s what Ben Graham taught us. A hundred years from now, they will still be the cornerstones of investing.” He has not been afraid to invest when others were scared, nor too anxious to patiently wait for opportunities when others were obsessed.

Many have compared the excitement of today’s stock market to that of the turn of the century market. They point to high valuations, narrow markets, and euphoria about the latest technology. There’s another potential similarity that I’ve not seen anyone else mention. As the last century was coming to a close, the investment zeitgeist completely embraced “growth” strategies (especially those associated with anything dot-com) and completely rejected traditional value investing. I noticed (without any real acknowledgment from the press) that long-time, historically successful value managers and strategists were retiring from major Wall Street firms. I have no idea whether their retirements were voluntary or not, but the phenomenon was clear to me at the time. Wall Street had no use for value anymore. In hindsight, that was exactly the time to reduce hyped-up growth and speculative strategies and, instead, add to value strategies.

Upstairs, Downstairs

The U.S. economy appears to be resilient, and corporate profits continue to grow, but there is churning beneath the surface.

Inflation remains sticky, and the unemployment rate, despite virtually zero immigration and mass deportation, is at its highest level in over 4 years. The number of Americans employed part-time for economic reasons has skyrocketed this year. These are workers who prefer full-time employment but are unable to find it. Note that this number, like all government statistics, is subject to revision, especially given the 43-day government shutdown.

Economists are confounded by the paradox of seeing strength in actual consumer spending at the same time that consumers are voicing increased pessimism. Perhaps the reason is that in surveys, every vote is equal (regardless of economic condition), but when it comes to spending, luxury items and services speak louder than essential, non-discretionary items.

Several quarters ago, we introduced the concept of the K-shaped economy in which high-income families were experiencing one economy and the rest of America was experiencing quite another economy. Sort of like the upstairs residents of Downton Abbey compared to the workers who lived downstairs.

Those in the top 10% of the income ladder now account for half of the nation’s spending. For the rest of the country, disposable personal income (after inflation) remained flat this year, and savings fell to the lowest level since 2022. Affordability is a real issue for those living paycheck-to-paycheck. Fortune reported that U. S. consumers used over $1 billion on Buy-now/Pay- later financing during Black Friday and Cyber Monday. These plans entice lower-income households to spend and then charge interest rates as high as 36 percent for those who miss a payment.

Grandparents Weekend

When I was very young, my grandparents were retired and living in a small one-bedroom apartment. They slept in twin beds, ala Lucy & Ricky. Their only income was a pension and social security. They would often visit my parents and me for the weekend. At some point during the weekend, my grandpa would pull me aside, give me a dollar bill, and tell me not to tell my Nana. At another point during the weekend, my Nana would take me aside, give me a dollar bill, and tell me not to tell my grandpa. I honored their wishes.

For much of the 21st century, the U.S. government has been slipping us dollar bills, in fact, trillions of dollar bills, but unlike my grandparents, the people we elect have bragged about it out loud, and we accept it as readily as I did from my grandparents. The reason is simple: politicians have learned that we hate taxes, but love having the things the government can provide. They do this by borrowing without any concern about who will eventually have to pay the debt. Heck, they seem to give little thought to even paying the current interest on the debt.

Sources: JP Morgan Asset Management, JPM Guide to Markets

The bond market is telling us in no uncertain terms that they don’t trust the policy-makers to deal with the deficit or debt. No matter how many times the Federal Reserve reduced the short-term Fed Funds rate in this cycle, the “bond vigilantes” have refused to play along, so long-term treasury yields remain elevated. The 30-year Treasury Bond started 2025 at 4.81% and ended 2025 at 4.84%. While the 30-year mortgage rates have dropped this year, that may be due to the housing slump, and even those rates remain stubbornly above 6%.

Staying The Defensive Course

By almost any measure, the U. S. stock market started 2025 overvalued and ended it even more expensive. Despite the tariff scare earlier in the year, the market posted its third year in a row of double-digit gains. December was the eighth month in a row of positive returns. Bull markets don’t generally die of old age, but the higher they climb, the greater the threshold becomes to exceed expectations.

According to Bloomberg, those expectations may be sky high as we enter 2026. The consensus among Wall Street strategists is another double-digit year. Historically, when opinion is unanimous, that expected outcome rarely comes to fruition. That could mean either significantly higher returns than expected or disappointing returns in 2026. Not only are the predicted returns all clustered together (around 11%), but the rationale for these returns is also uniform: tax cuts, rate cuts, deregulation, AI-capex dominated growth, and productivity boom. The following Wall Street Journal headline sums up the euphoria: “Bankers Are Gearing Up For Another Onslaught of Monster Deals in 2026.” Investment firms and their lawyers have gone on a hiring spree. 47% of Goldman Sachs clients are “slightly bullish: while another 14% are “outright bullish.” None of this leaves much room for disappointment or surprises.

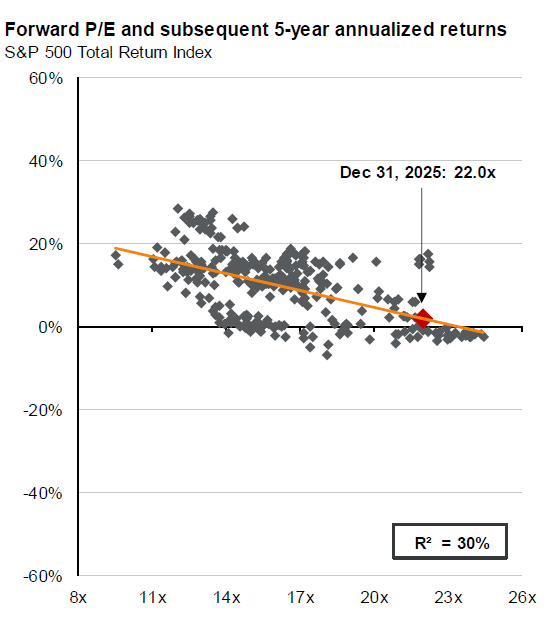

Source: FactSet, Refinitiv Datastream, Standard & Poor’s, J.P. Morgan Asset Management. Returns are 12-month and 60-month annualized returns, measured monthly, beginning 12/31/1993. R2 represents the percent of variation in total return that can be explained by forward P/E ratios. The forward P/E ratio is the most recent S&P 500 index price divided by consensus analyst estimates for earnings in the next 12 months, provided by IBES since December 1993 and FactSet since January 2022. Past performance is no guarantee of future results.

Extreme valuations are best used to understand the level of risk in the market, but are not a reliable timing tool. Stocks can remain expensive for extended periods of time- sometimes longer than can seem possible.

Extended valuations are vulnerable to correction, and as Fed Chairman Powell recently observed, “there is no risk-free path,” so we remain defensive. As Warren Buffett has advised, always maintain a “margin of safety.”

– Andrew T. Gardener, CFP®